Building a Collaborative LTL Freight Community with Factoring

- Renee Williams

- Jun 10, 2025

- 3 min read

Updated: Nov 16, 2025

In today’s fast-moving logistics landscape, the Less-Than-Truckload (LTL) freight market plays a critical role in keeping supply chains efficient and connected. But at the heart of this industry isn’t just trucks and freight—it’s the people who make it run. From owner-operators to shipping vendors and dispatchers, the strength of the LTL community lies in collaboration. And yet, despite this shared mission, working together can often be disrupted by the same challenges that have plagued the freight world for decades: cash flow shortages, delayed payments, and administrative bottlenecks.

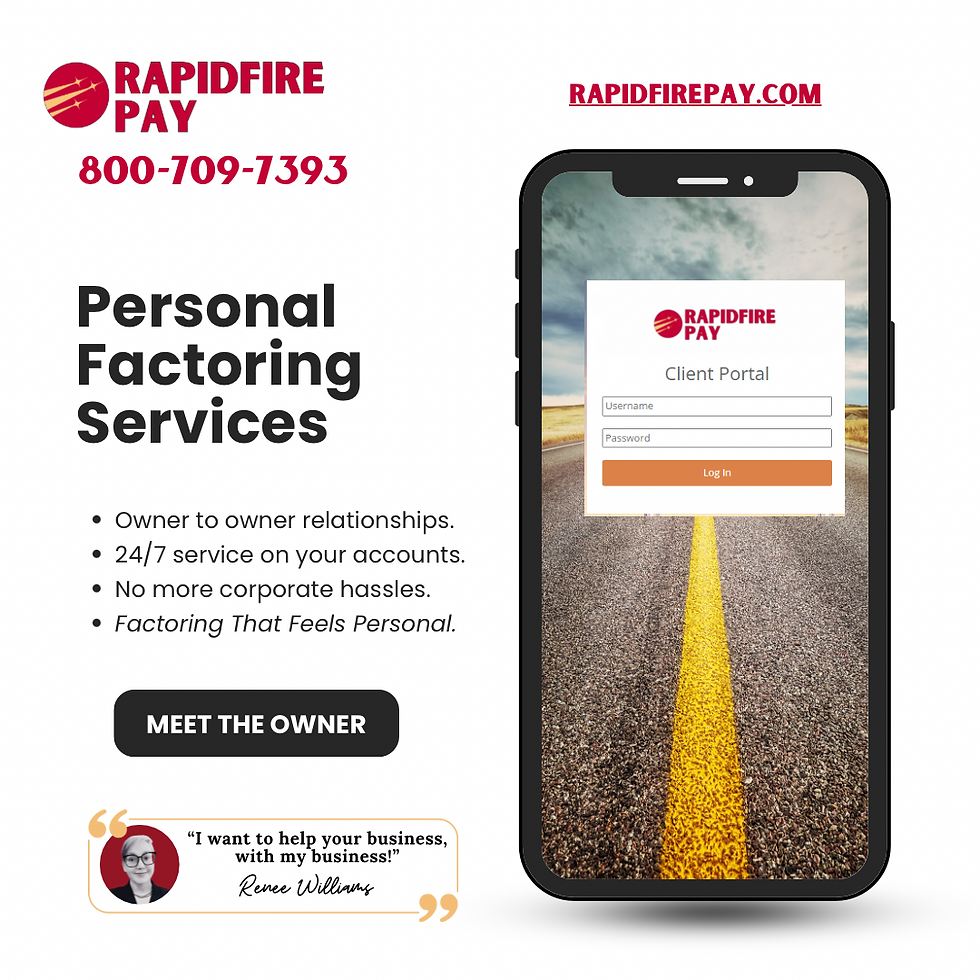

At Rapidfire Pay LLC, we believe in solving more than just financial issues—we believe in fueling connection, efficiency, and trust. Let’s explore how factoring services can create a stronger, more collaborative LTL freight community.

The Role of Collaboration in the LTL Freight Community

The LTL model is built on shared resources—multiple shippers sharing space on a single truck. That very structure depends on coordination and cooperation. When dispatchers, drivers, freight brokers, and shippers work together seamlessly, the entire process becomes more efficient and profitable.

A dispatcher coordinating with trusted carriers can ensure freight moves quickly and cost-effectively.

Drivers benefit from transparent schedules and quicker turnaround times.

Vendors build lasting relationships when communication and payments flow without friction.

We’ve seen partnerships where small LTL fleets band together to optimize routes, reduce empty miles, and share warehousing—all made possible by a foundation of mutual trust and financial consistency.

Challenges Faced by the LTL Freight Community

Despite good intentions, the LTL world isn’t without obstacles:

Cash flow gaps caused by net-30 or net-60 payment terms from brokers or shippers.

Delayed payments that can leave owner-operators struggling to cover fuel, repairs, and payroll.

Administrative overload from managing invoices, collections, and payment tracking.

These challenges slow down collaboration. A vendor might hesitate to release freight until they’re paid. A dispatcher may avoid working with smaller fleets that lack financial backing. And drivers, often last to be paid, are forced to take time off the road to chase payments or manage bills.

How Factoring Services Can Facilitate Collaboration

This is where Rapidfire Pay LLC steps in. We’re not just a financial tool—we’re your outsourced partner in back-office strength and financial reliability.

Factoring is simple: we purchase your invoice and provide immediate cash, so you don’t have to wait weeks to get paid. With Rapidfire Pay:

You get same-day ACH funding.

Your clients pay us directly—but your business remains in control.

You gain peace of mind, knowing you can pay fuel, payroll, and overhead on time—every time.

When cash flow is stable, collaboration flourishes. You’re free to grow partnerships, take on more loads, and build trust across the supply chain. No stress, no delays—just progress.

In the LTL freight world, collaboration isn’t a luxury—it’s a necessity. But for that collaboration to work, everyone needs financial predictability, trust, and access to resources. Factoring services like those offered by Rapidfire Pay LLC don’t just solve payment issues—they remove the roadblocks that keep people from working together.

If you're ready to move past financial roadblocks and build something stronger with your partners, now’s the time. Let Rapidfire Pay LLC help you build a more collaborative, efficient, and profitable LTL freight business.

💻 Visit www.RapidfirePay.com

📞 Call us at 1-800-709-7393

📧 Email us at sales@rapidfirepay.com

You keep moving freight—we’ll keep your cash flowing.

Comments